Imagine you’re Lucas, a digital entrepreneur from Brazil, running a successful U.S. LLC. Your profits are impressive, your business is thriving, but suddenly, you’re hit with a steep withholding tax on payments from foreign clients. Anxiety creeps in. How can you legally protect your hard-earned income? The solution: securing a U.S. tax residency certificate (Form 6166).

In this guide, I’ll demystify exactly how you, as a foreign entrepreneur, can easily obtain this critical certificate, reduce your tax burden, and boost your global financial confidence.

Why You Need a U.S. Tax Residency Certificate

You might wonder, “Why go through this hassle?” Here’s why: Without this certificate, you risk double taxation—paying taxes twice on the same income. It’s essential for leveraging international tax treaties, ensuring foreign clients and governments don’t unnecessarily withhold tax from your payments. Simply put, Form 6166 proves to foreign entities that your business has legitimate U.S. taxpayer status.

Do You Qualify? Here’s the Deal

Unfortunately, if your LLC is solely foreign-owned and not taxed as a U.S. corporation, you’re out of luck—you simply don’t qualify. But don’t despair. If you structure your LLC as a corporation or if your business genuinely pays U.S. taxes, you’re eligible to obtain this valuable document

Your Step-by-Step Path to Form 6166

Let’s walk through exactly what you’ll do:

Step 1: Confirm Your U.S. Tax Status

First things first, ensure you’re legitimately filing or will file a U.S. tax return (Form 1120 for corporations). This sets your foundational qualification.

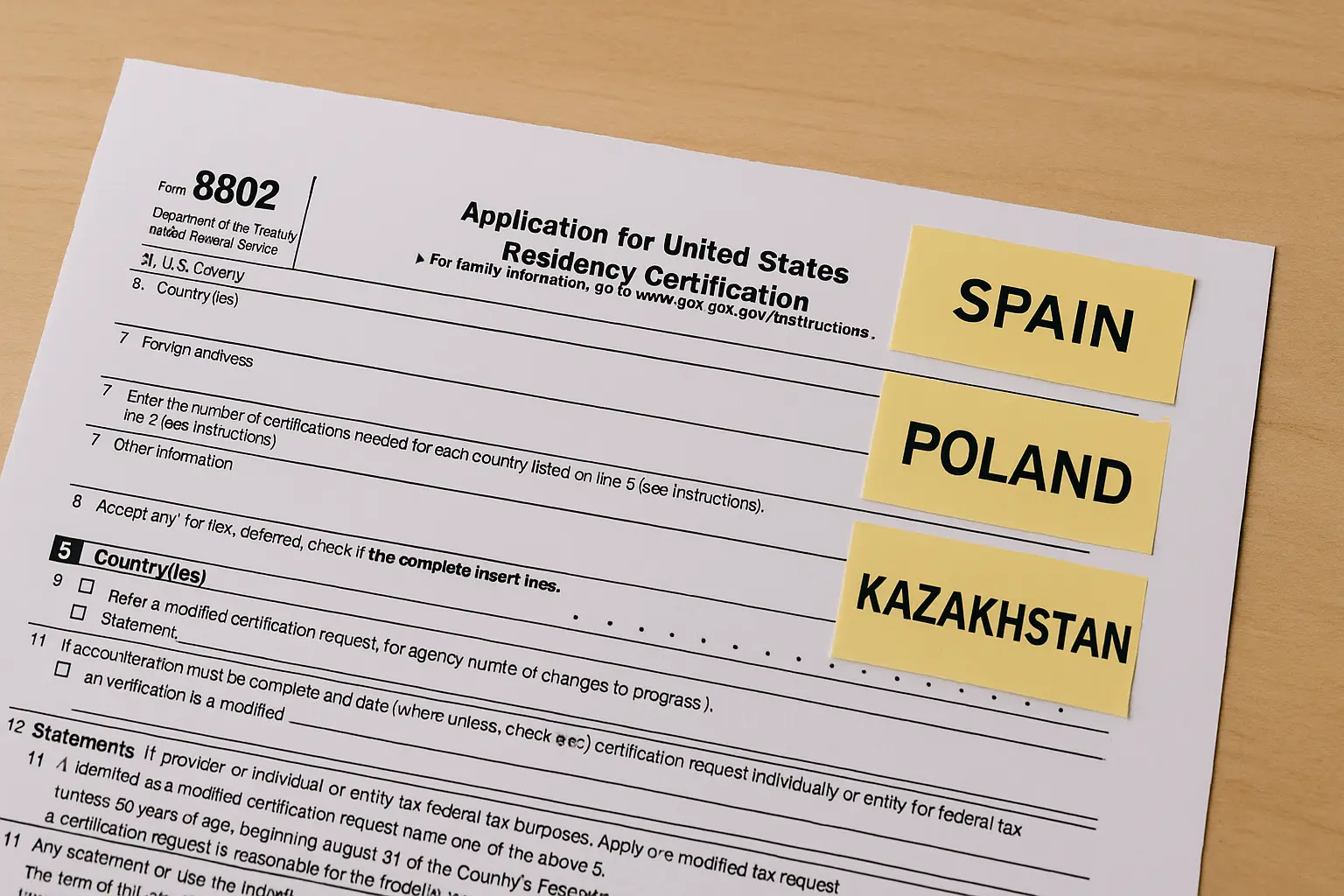

Step 2: Complete Form 8802

Form 8802 is your official request to the IRS. It’s straightforward—three short pages—but essential. You’ll fill in basic details like your business name, Tax ID (EIN), and the countries requesting the certificate.

Step 3: Pay the IRS Fee

The IRS requires a user fee—currently $185 per Form 8802. Pay directly on pay.gov, save your confirmation, and attach this payment evidence to your form.

Step 4: Submit and Stay Proactive

After submission via mail, private delivery, or fax (highly recommended for quick tracking), the IRS claims processing takes about 90 days. Realistically, it often takes longer, so be proactive—follow up regularly until your Form 6166 arrives.

What If You Don’t Qualify Initially?

If your business doesn’t initially qualify, there’s a strategic workaround. Consider setting up a secondary U.S. corporation specifically designed to obtain this certificate. Then legally funnel your significant foreign payments through this structure, ultimately achieving significant tax savings. Always ensure proper documentation to avoid compliance headaches later.

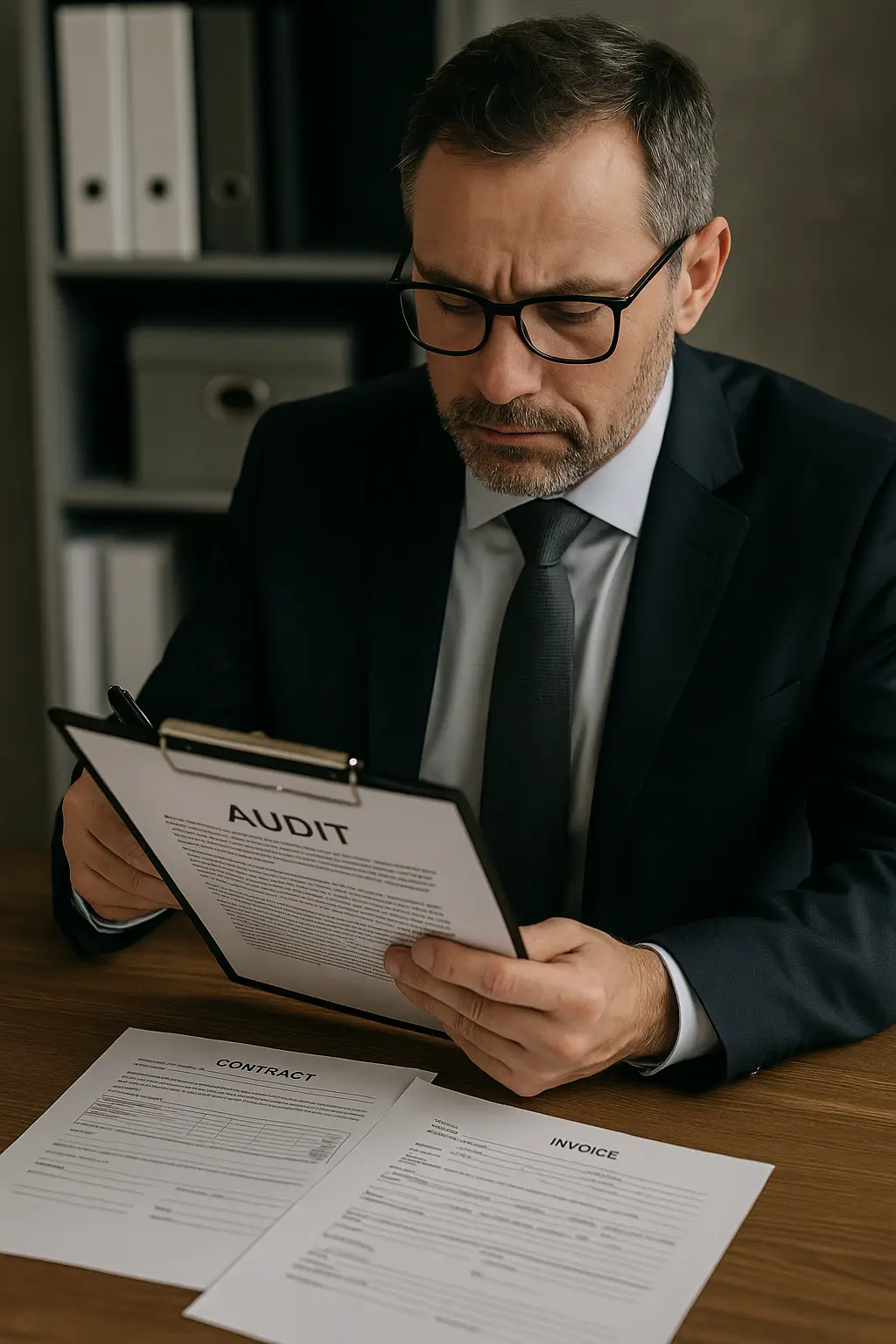

The Secret Sauce to Avoid Audit Worries

Concerned about audits? Relax. They’re rare, but preparedness is key. Keep meticulous records:

- Signed and dated contracts

- Documented invoices and payments

- Detailed justification for all financial arrangements

Your records are your armor, protecting your business and peace of mind.

Simplify Your Journey—We’re Here to Help

Navigating U.S. tax law complexities doesn’t have to feel overwhelming. With the right guidance, obtaining your U.S. tax residency certificate is straightforward. Take the first step to clarity and financial empowerment today.

Schedule Your Personalized Consultation Now

Curious to learn more? Dive deeper into powerful tax strategies on our comprehensive blog.

FAQ – Quick Answers for Foreign Founders

Any foreign entrepreneur or business needing to prove U.S. taxpayer status to avoid double taxation through tax treaty benefits.

No, your LLC must be taxed as a U.S. corporation or have a genuine U.S. tax liability to qualify.

The IRS states 90 days, but practical experience shows it can take longer. Regular follow-up is essential.

Yes, clearly list each country and quantity needed on your Form 8802 application.