US Tax Treaties for Non-US Entrepreneurs: How to Legally Pay 0% on Eligible Income

There is a turning point in every global founder’s journey when marketing wins stop being […]

Reduce IRS Audit Risk as a Non-US Founder: The Playbook That Keeps You Off the Radar

Imagine this: you run a lean, profitable business from Lisbon, Singapore, or Medellín. Clients love […]

How Non-Residents Are Hacking U.S. Bank Account Openings Without Fail: Proven Strategies

Imagine you’re Ana, an entrepreneur based in Colombia trying to open a U.S. […]

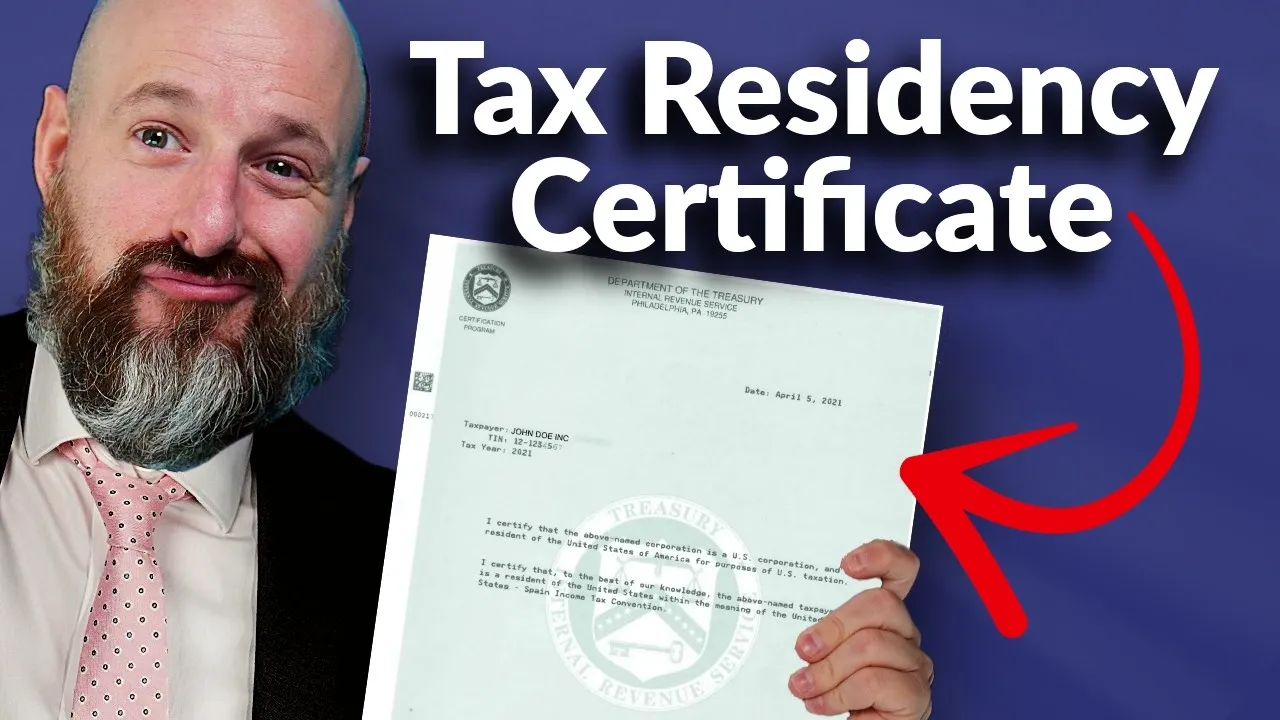

How to Easily Get a U.S. Tax Residency Certificate as a Foreign Entrepreneur (Step-by-Step Guide)

Imagine you’re Lucas, a digital entrepreneur from Brazil, running a successful U.S. LLC. Your profits […]

How Foreign Entrepreneurs Legally Avoid Taxes with a U.S. LLC

Imagine you’re Reggie, an ambitious entrepreneur based in Italy with thriving rental properties in the […]

How to Open a U.S. Bank Account as a Non-Resident (2025 Guide for Entrepreneurs & Freelancers)

Why U.S. Banking is the Key to Playing in the Big Leagues

Picture this: […]

Wise Is Freezing Accounts in 2025—What Non-Residents Must Know (Before It’s Too Late)

It All Starts With One Email…

“We’re sorry to inform you that your Wise account has […]

How to Open a U.S. Bank Account as a Non-Resident in 2025—3 Proven Paths That Actually Work

How to Open a U.S. Bank Account as a Non-Resident in 2025—3 Proven Paths That […]

How to Open an LLC in the US as a Foreigner: A Complete Guide

When Ana, a designer in Spain, closed her biggest U.S. client yet, she celebrated. But […]

How to Choose the Right State for Your LLC: Real Formation and Annual Fees Breakdown (2025)

How to Choose the Right State for Your LLC: Real Formation and Annual Fees Breakdown […]