LLC vs C-Corp for Nonresidents is the decision that turns theory into money, risk, and sleep. If you’re a foreign founder selling to the U.S., this 2025 guide gives you a no-fluff path to structure, taxes, filings, and banking—so you move fast without penalties. And if you want a tailored blueprint for your facts

book a free strategy call with James Baker, CPA right now.

The Stripe ping hits Lucía’s phone in Bogotá at 6:03 a.m. First U.S. client paid. She smiles, then freezes: a founder friend DMs three words that feel like a cold shower—“Did you file 5472?”

That’s the moment when LLC or C-Corp stops being theory and becomes your money, your risk, your sleep. If you’re here for clarity without fluff, you’re in the right room. And if at any point you want your facts mapped to a clean structure, book a free strategy call with James Baker, CPA—we’ll give you the shortest compliant route from “confused” to “confident.” Schedule here

Why state hype keeps ambushing smart founders

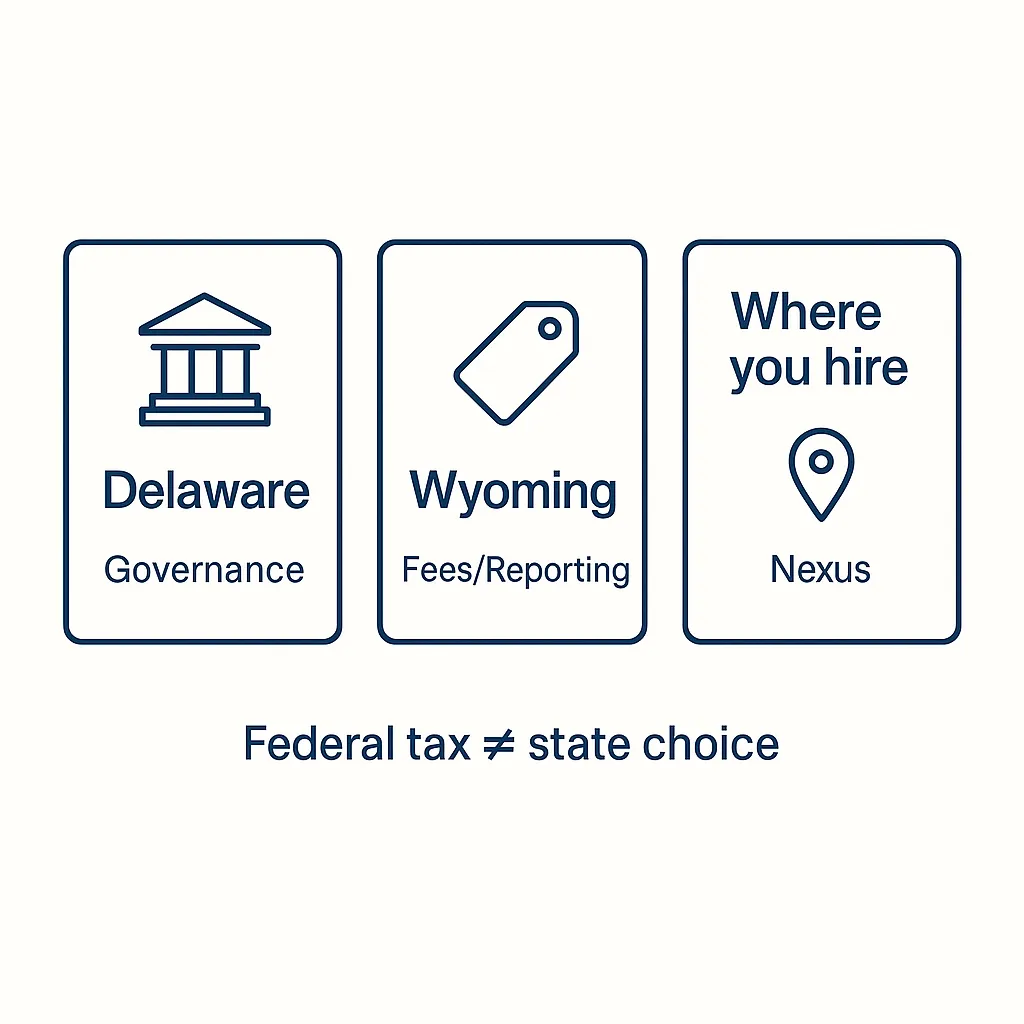

There isn’t a magic U.S. state that deletes federal tax. Structure + presence decide exposure, not a pretty registered-agent address. Delaware is great for governance; Wyoming has admin perks. But neither is a get-out-of-federal-tax card. If someone promises “0% forever because [state],” they’re selling fairy dust.

Want the non-myth version tailored to your footprint and team plans? Grab a 15-minute slot—we’ll draw your decision tree in plain English. Book your call.

Prefer reading first? We keep pragmatic, up-to-date primers on the Blog, open a tab now and compare later.

Two founders, two paths—both calm if you choose early

Lucía runs a remote creative studio serving U.S. clients from abroad. No U.S. office, no employees on U.S. soil, no services physically performed in the States.

Her best fit? Single-member, foreign-owned LLC.

-

When she truly avoids U.S. ECI (effectively connected income), the entity typically owes no U.S. income tax on profits.

-

But she must file a pro-forma Form 1120 + Form 5472 every year, complete BOI (FinCEN) on time, and keep contracts showing where services are performed.

-

Done right, she protects margins and sleeps in April.

If this sounds like you, don’t gamble the filings—book a quick check so we can sanity-test your facts and paperwork. Schedule now.

Omar is different. He’s hiring in Miami, signing a lease, talking to U.S. funds.

His best fit? C-Corporation.

-

The corporation is the U.S. taxpayer (Form 1120, 21% federal + potential state tax).

-

Clean payroll, familiar governance (bylaws, board, minutes), investor-ready cap table.

-

Translation: fewer eyebrows during diligence.

If you’re on a VC or hiring track, get the scaffolding right from day one—book the call before your first W-2 lands. Schedule here.

And if you want to weigh pros/cons solo first, we’ve laid out investor-grade checklists on the Blog.

The decision map you can explain to a co-founder in 60 seconds

If the next 12 months are remote (services or e-com managed abroad; no U.S. office/employees) → LLC is usually your unfair advantage.

If you’ll hire on U.S. soil, sign leases, run inventory, or pursue institutional capital → C-Corp is your exoskeleton.

Still split? Two minutes of context often flips the answer. Book the strategy call and leave with a decision you can defend.

What “ECI vs. FDAP” really means—without the jargon

Picture two buckets:

-

ECI is profit effectively connected to a U.S. trade or business—think work actually performed in the U.S. or a fixed place of business there. That invites U.S. income tax.

-

FDAP is fixed or determinable annual or periodic income (like certain passive payments) often handled via withholding.

Most remote founders obsess over states and miss the real lever: where the value is created. If the brains, operations, and delivery are outside the U.S., your LLC often avoids ECI at the entity level—but only if the paperwork tells the same story. Unsure how your contracts read? Bring a sample to a quick consult and we’ll mark up the weak spots. Schedule here.

(Deep dives and glossaries live on the Blog if you want to nerd out first.)

The filings that actually bite (it’s not the tax—it’s the penalties)

If you’re the foreign-owned SMLLC (Lucía’s route)

-

Annual filings: pro-forma 1120 + 5472 (yes, even when no tax is due).

-

If more than one owner: default partnership → Form 1065 + K-1s.

-

FinCEN BOI: most entities must file and update upon changes (ownership/officers/addresses).

-

Hygiene: Operating Agreement (even solo), contracts clarifying where services are performed, W-8/W-9 discipline.

-

Banking: open only after EIN + docs; choose providers familiar with non-resident KYC.

Already formed and fear you missed something last year? Don’t wrestle it alone—we fix these weekly. Book a triage call and we’ll reduce penalty exposure fast.

If you’re the C-Corp (Omar’s route)

-

Governance: issue shares, adopt bylaws, appoint directors/officers, keep minutes.

-

Tax: Form 1120, plus any state corporate filings; run payroll clean.

-

Licenses & nexus: register where you actually operate; plan multi-state early.

If your board book is a Google Drive jungle, we’ll sequence it into investor-grade order. Schedule here. For a DIY warm-up, the governance primers on the Blog are a solid start.

A first-year timeline that keeps founders sane

Month 0–1: Form the entity, get the EIN, draft the Operating Agreement (LLC) or bylaws/share issuance (C-Corp), and plan BOI.

Month 1–2: Open banking/fintech with a consistent KYC story (same addresses, same officers across docs).

Quarterly: Review contracts and where services are performed; maintain minutes (C-Corp).

Year-end: Pre-close checklist—1099/W-8/W-9 hygiene, state annual reports, registered agent renewal.

Tax season: File the right return (5472/1120 pro-forma for SMLLCs; 1065 for multi-member; 1120 for C-Corp).

Want this baked into a single calendar with reminders? Ask on your consult—we’ll load it for you. Book the call. Or bookmark the templates on the Blog.

Banking reality for non-residents—what approvals really hinge on

Banks don’t reject you for being foreign; they reject inconsistent stories. If your formation address, operating address, contracts, and website say different things, compliance red-flags explode.

Tighten the narrative: one primary address, officers that match formation docs, contracts that reflect where you work, and a website that doesn’t scream “mailbox business.” If you’ve been rejected before, we’ll spot the mismatch in minutes—schedule a quick review. For a longer read, see our banking playbooks on the Blog.

Marketplace sellers, SaaS, and “hidden” presence

-

Marketplace/e-com: If inventory sits in U.S. warehouses, that can create nexus (state obligations) even when you operate abroad.

-

SaaS: Cloud servers in the U.S. aren’t automatically a tax presence; people and decision-making matter more.

-

Contractors: U.S. contractors don’t automatically create ECI, but sloppy agreements do.

If any of this describes you, don’t default to a forum myth. Bring the facts; we’ll model the exposure and document a clean posture. Book here. Want to sanity-check terms first? Skim the contractor/nexus posts on the Blog.

State choice without the clickbait (short, honest, useful)

Federal tax ≠ state choice. Pick for courts/governance (Delaware), fees/reporting (Wyoming), banking relationships, and where you’ll actually hire or store inventory. If you’ll hire in Florida, pretending you “live” in Wyoming is cosplay—compliance will catch up. Need a state pick you can explain to investors? We’ll draw the tradeoffs on a single page. Schedule the session. Then keep the one-page recap handy alongside our deeper state guides on the Blog.

Close the loop—so April isn’t a horror film (and December isn’t either)

Lucía signs three more U.S. clients, keeps delivery offshore, files 5472/1120 on time, BOI done, and sleeps.

Omar closes a seed round because his C-Corp governance doesn’t trigger diligence alarms.

If you want that level of quiet confidence, get your decision validated now—Schedule with James Baker, CPA—and bookmark the evolving checklists on the Blog so the rules don’t surprise you.

FAQ – Quick Answers for Foreign Founders

Generally no at the entity level if profits aren’t ECI—but you still must file pro-forma 1120 + 5472 each year. If you’re not sure whether your work counts as U.S.-sourced, let’s clarify it on a quick call: book here.

Yes, but default is a partnership for tax (Form 1065 + K-1s). We’ll outline roles, capital contributions, and a clean operating agreement—schedule it. For background, compare structures on the Blog.

There’s no federal-tax magic. Choose for governance (Delaware), admin/fees (Wyoming), banking, and where you’ll actually operate. For a crisp state pick in your context, scan our primers on the Blog and then book the call to finalize.

Yes, with the right KYC stack (EIN + proper docs + a consistent story). If you’ve been rejected before, we’ll fix the weak link—schedule the consult.

Not by itself. People and decisions matter more. If your devs or decision-makers sit in the U.S., facts change. Bring your setup; we’ll model exposure—schedule a review. For a primer, check the SaaS articles on the Blog