The Belize Real Estate Trap: Why Most Foreign Investors Lose—and How to Win with the Baker Two-Step.

Maybe you’ve heard the dream: “Buy land in Belize, own a slice of paradise, retire rich.” But behind the turquoise waters and palm trees lurks a tangle of legal, fiscal, and bureaucratic traps that eat inexperienced investors alive.

I’ve watched them fall—again and again. People like you, smart and resourceful, but working with bad information, the wrong advisors, or just too much trust in the system.

I know because I am one of you. I’m not just a CPA, I’m an investor who owns property in Belize, has been on the ground with local realtors, and has walked this minefield for myself and dozens of clients.

And after years of fixing costly blunders for others, I built a system that flips the script: The Baker Two-Step.

How the Dream Turns into a Nightmare

Let’s break the myth: Buying property in Belize is nothing like buying in the US, Canada, or Europe.

You don’t just sign a contract, wire the funds, and get your title. Instead, you face a legal maze—stamp taxes, foreign ownership restrictions, opaque processes, and if you blink, you’ll end up paying thousands more (or even losing your property).

Here’s the silent killer: Most foreigners invest in their own name or through a basic company setup. Seems safe—until you try to rent, sell, or pass your property to heirs. Suddenly, you’re slammed with Belizean stamp taxes (up to 8%), endless paperwork, and zero asset protection.

I’ve seen it all: American entrepreneurs who lose money on resale, digital nomads whose assets get tangled in legal disputes, expat freelancers facing IRS nightmares because they structured things the “easy way.”

The Baker Two-Step: Outthink, Outmaneuver, Outprofit.

If you’re still with me, you’re not looking for “easy.” You want

The Baker Two-Step is the playbook I created after years of battle-testing—first for myself, then for every client who was tired of leaving money and security on the table.

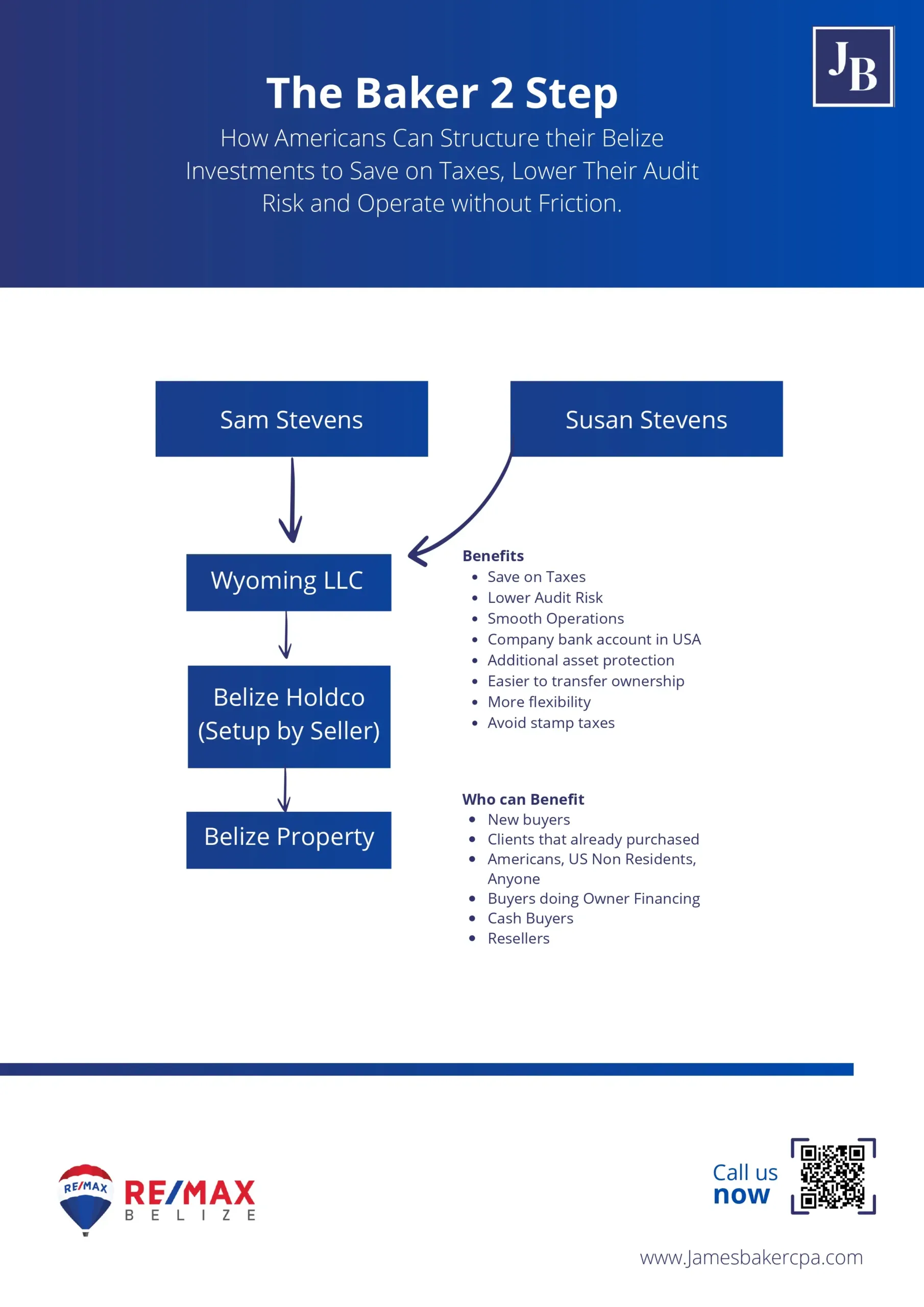

Step 1: Create a US LLC in your name.

Step 2: Have that LLC own an offshore company (usually Anguilla or Belize-based) which holds title to the property.

Why this structure? Simple. It lets you…

-

Sidestep Belize’s punishing stamp taxes when selling—saving up to 8% instantly.

-

Shield your assets from legal attacks, claims, and liability.

-

Stay invisible: The offshore layer keeps your name out of public records.

-

Simplify your taxes: You can “cleanly” separate your Belize income/expenses, making IRS compliance easier and less risky.

-

Transfer or sell with a simple share transaction, not a real estate nightmare.

-

Operate like a real business: Whether you’re renting, flipping, or just holding, everything’s tracked and managed the way serious entrepreneurs do.

This isn’t theory. I’ve implemented it for American investors, European founders, Asian digital nomads, and even local Belizeans who want to play by international rules.

It’s the edge that turns you from “tourist with money” to “global investor with power.”

Why Most Advisors Get It Dead Wrong

Let’s cut through the noise: Most attorneys and “experts” push one-size-fits-all solutions. They’re not in the trenches. They don’t own property themselves. They haven’t been hit by a Belizean tax audit or spent weeks untangling ownership disputes across borders.

Their advice? “Just open an Anguilla company.” Or worse, “Buy in your own name—it’s easier.”

Easy is expensive. Easy is dangerous.

I’m not here for easy. I’m here for right.

The Baker Two-Step is flexible. Maybe your situation is different. Maybe you want to live in Belize, run Airbnbs, or flip land for profit. The structure adapts.

But the principle is non-negotiable: Protect yourself before you play the game—or prepare to pay the price.

Ready to Build Your Fortress?

You don’t have to be a millionaire or a lawyer. You just need someone who’s done it before, seen the pitfalls, and built a system for winning.

That’s what the Baker Two-Step delivers.

I’ve walked the path. I’ve built the solution. Now it’s your turn to step up—before the next round of stamp taxes, legal headaches, or IRS letters arrives.

Let’s talk about your real situation. Your goals. Your risks. Your legacy.

Your Next Step: Claim Your Spot, Claim Your Advantage

Most readers will leave this page and make the same mistakes others have made—hoping it “works out.”

The ones who win? They take the step before disaster strikes.

-

Book a confidential strategy session here: Schedule a call with James Baker CPA

-

Want to dig deeper into international strategies and success stories? Explore the main blog