How to Choose the Right State for Your LLC: Real Formation and Annual Fees Breakdown (2025)

Forming a U.S. LLC isn’t just a box to check—it’s a long-term decision. And for non-resident founders, choosing the wrong state could mean higher taxes, double registration, hidden costs, or bank account issues down the road.

At James Baker CPA, we help international entrepreneurs register and maintain their U.S. companies with full compliance and no surprises.

This guide gives you the 2025 filing and annual fees—plus the strategy behind the numbers.

📞 Avoid the most expensive mistakes international founders make.

The Two Real Costs of Forming an LLC

When forming an LLC, most founders fixate on the filing fee—the one-time cost to register. But that’s just the beginning.

The real burden comes later in the form of recurring fees: annual reports, franchise taxes, registered agent renewals. Ignore them, and your company risks suspension or dissolution.

We break them both down below—with real numbers, real impact.

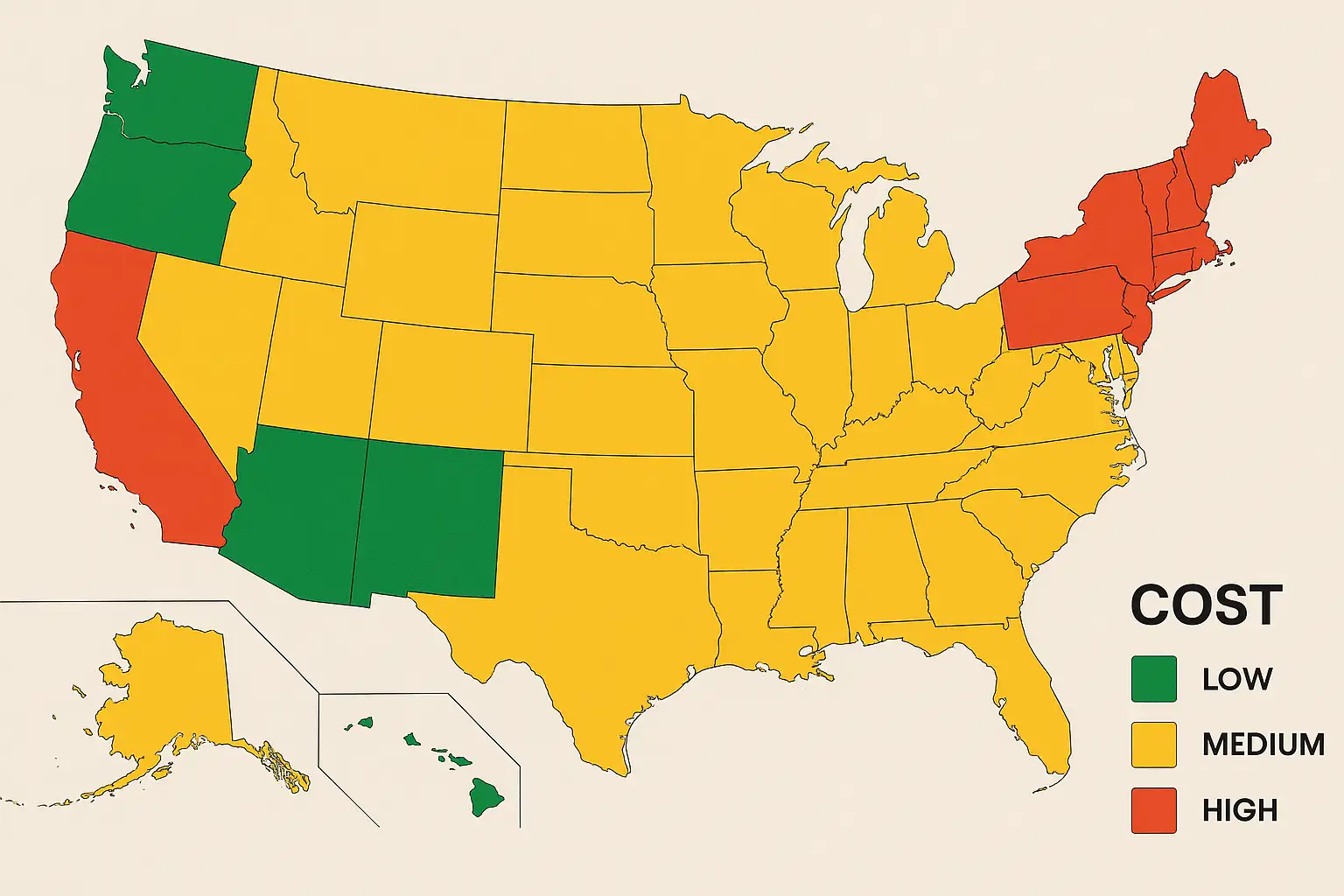

LLC Filing & Maintenance Fees by State (2025)

| State | Filing Fee | Annual / Franchise Fees |

|---|---|---|

| Wyoming | $100 | $60 annual report |

| Delaware | $90 | $300 franchise tax |

| Florida | $125 | $138.75 annual report |

| Texas | $300 | No annual fee (margin tax applies) |

| California | $70 | $800 minimum franchise tax |

| New Mexico | $50 | $0 (no annual report required) |

| New York | $200 | $9 biennial report + publication required |

📌 Fees may change annually. We track every update for our clients and handle filings on their behalf.

Why “Cheap” Isn’t Always Smart

Forming your LLC in a low-fee state might look appealing. But here’s what we see repeatedly with international clients:

- They form in Delaware without knowing about the $300 franchise tax.

- They pick New York, then get blindsided by publication requirements that cost up to $1,200.

- They operate from one state, register in another, and end up paying both.

Our advice is simple:

Choose the state that aligns with your business operations, tax exposure, and compliance capacity—not just the price tag.

Hidden Fees No One Talks About

- Franchise taxes apply regardless of revenue (especially in California and Delaware).

- Foreign qualification fees hit if you’re doing business in a different state from where you formed.

- Registered agent services are required in every state—budget $100–$150/year if not bundled.

- Late reports or missed filings can result in $200–$500 reinstatement penalties.

😓 Many founders don’t learn this until their Stripe account freezes or their bank flags their LLC as inactive.

What’s the “Best” State to Form an LLC?

There is no universal answer—but here’s how we approach it:

| Goal | Suggested State |

|---|---|

| Low fees + easy maintenance | Wyoming / New Mexico |

| Stripe or fintech-friendly | Florida / Delaware |

| Physical U.S. presence | Your home state |

| Avoid publication requirements | Avoid New York |

| No annual reportsNo annual reports | Consider New Mexico |

We don’t guess. We evaluate. Then we register your LLC the right way.

✅ Let’s build the right foundation for your U.S. company—compliance-first, cost-efficient, and growth-ready.

Quick Cost Summary

| Cost Type | Typical Range |

|---|---|

| Filing fee | $50 – $300 |

| Annual report / tax | $0 – $800+ |

| Registered agent | Included with us |

| State-specific extras | $0 – $1,200 |

| Total (Yr 1 + Yr 2) | $150 – $2,000+ |

Final Thought: Shortcuts Today Cost Thousands Tomorrow

It’s easy to find a $99 LLC formation service. It’s much harder to fix your filings when the IRS sends a letter or your bank locks your account.

We’ve helped hundreds of founders like you make clean, informed decisions—and grow U.S. companies that stay active, compliant, and fundable.

👉 Book your free strategy call

We’ll help you form in the right state, file on time, and sleep easier.

Frequently Asked Questions (FAQs)

If you live in the U.S., yes—you’re typically required to register in your home state.

If you’re a non-resident, you can choose any state—but not all are equally practical.

We often recommend Wyoming or Florida, depending on your goals. Wyoming is simple and low-cost; Florida is highly compatible with fintech platforms like Stripe.

Your LLC can be marked “not in good standing,” suspended, or dissolved. It can also trigger issues with your U.S. bank or payment processor.

Technically, yes—via domestication or forming a new LLC and dissolving the old one. But it’s better to make the right choice upfront to avoid fees and legal confusion.

Yes. Every U.S. state requires an LLC to maintain a registered agent with a physical address in the state. We provide this service in all 50 states.